Reviews

220

Reviews

48

Reviews

31

220

Reviews

48

Reviews

31

Reviews

Empowering You to Compare Over 80+ Leading Personal Loan Options

- Take charge of your loan decisions

- Find your match in minutes

Get Your Personalised Quote!

Get Your Personalised Quote!

Personal LoansFor You

Journey Finance offers personal loans to all Australian residents. With our expertise in finance, we understand the financing process for your personal loan. Our loan wizards will help you find the best personal loan, customized to your needs, from our network of lenders, regardless of the purpose.

Flexible Personal Loans Tailored to Your Needs

At Journey Finance, we specialize in providing flexible personalloans that are tailored to meet your specific needs. Whether you’re wanting to go on holiday, do those renovations, need it for a medical procedure or evenconsolidate your debts. Our extensive experience in the field of personal loan finance allows us to understand the intricacies involved in securing the right financing for your needs. Our team of dedicated loan consultants will guide you through the process, helping you find the perfect personal loan solution. We work closely with a wide network of lenders, ensuring that we can offer you competitive finance options regardless of the reason.

Understanding How A Personal Loan Works

When seeking finance for a personal loan, it is important to meet the following basic criteria to be eligible for a personal loan. Be 18+ years of age, a citizen or resident of Australia, earning over $30,000 per year and not be in financial hardship. Personal loans are a form of unsecured credit, meaning the funds go directly to you and are able to be used all at once or over a period of time. Personal loans are great for many different reasons but can be one of the fastest ways to access funds within 24 hours.

Is a Personal Car Loan Suitable for Me?

While personal loans may have higher interest rates compared to the secured car loans provided by Journey Finance, they offer several advantages. When considering car financing options, the variety can be overwhelming. Opting for a personal car loan brings benefits such as the absence of payout penalties, allowing you to sell the car or pay off the loan early without incurring additional charges. Additionally, you have the flexibility to purchase a vehicle from any source, be it a dealer or private seller, and personal car loans often accommodate older car purchases that secured loan lenders may decline. Enjoy the freedom to finance a new or used car of any make or model with a personal car loan.

How to Maintain Low Monthly Repayments?

To minimize the loan expenses, it is advisable to secure a loan with the lowest interest rate available from our lenders. Opting for a longer loan term, ranging from one to seven years, can help keep the monthly repayments affordable. However, it is important to note that extending the loan duration may result in a slightly higher overall cost.

Why Choose Journey Finance

Ready to secure a car loan for your next vehicle purchase? Fill out our simple application form HERE or call 1800 861 009 to speak with one of our knowledgeable car finance consultants. Trust us to provide a seamless car finance experience that puts you behind the wheel in no time.

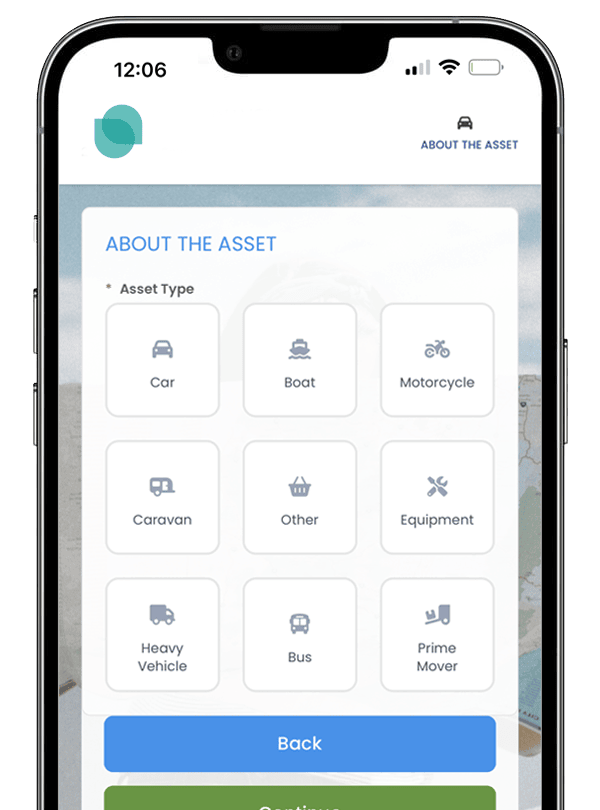

Our process

1. Get your quote

Get your personalized quote in minutes! Simply upload your supporting documents and sign our privacy agreement, and we’ll hit the ground running.

2. Submit for approval

Once you’ve submitted your application, our finance experts will meticulously review it and ensure the highest chance of approval before proceeding.

3. Approve

When approved, it’s time to celebrate! Our process doesn’t stop at approval – we’ll swiftly prepare your loan documents for signing, ensuring funds reach you, the dealership, or private seller within 24 hours.

4. Contracts & settle

Once we’ve secured your approval and received all the necessary documents, it’s go time! Our loan wizards will work their magic and prepare your spellbinding loan documents for signing. Before you can say abracadabra, we’ll whisk away the funds to you, the dealership, or even that elusive private seller within a mere 24 hours.

Our process

1. Get your quote

Get your personalized quote in minutes! Simply upload your supporting documents and sign our privacy agreement, and we'll hit the ground running.

2. Submit for approval

Once you've submitted your application, our finance experts will meticulously review it and ensure the highest chance of approval before proceeding.

3. Approve

When approved, it's time to celebrate! Our process doesn't stop at approval - we'll swiftly prepare your loan documents for signing, ensuring funds reach you, the dealership, or private seller within 24 hours.

4. Contracts & settle

Once we've secured your approval and received all the necessary documents, it's go time! Our loan wizards will work their magic and prepare your spellbinding loan documents for signing. Before you can say abracadabra, we'll whisk away the funds to you, the dealership, or even that elusive private seller within a mere 24 hours.

249

Glowing Google reviews that leave a lasting impression

Still have questions?

Ready to look for a better deal?Take the first step…

We have access to a panel of lenders who will find the best deal for you based on your current circumstances. Our questionnaire only takes 1 minute to fill out, won’t affect your credit score and could save you thousands!

Ready to look for a better deal? Take the first step…

We have access to a panel of lenders who will find the best deal for you based on your current circumstances. Our questionnaire only takes 1 minute to fill out, won’t affect your credit score and could save you thousands!